Incremental Insights #1

A collection of links highlighting the best insights from other investors.

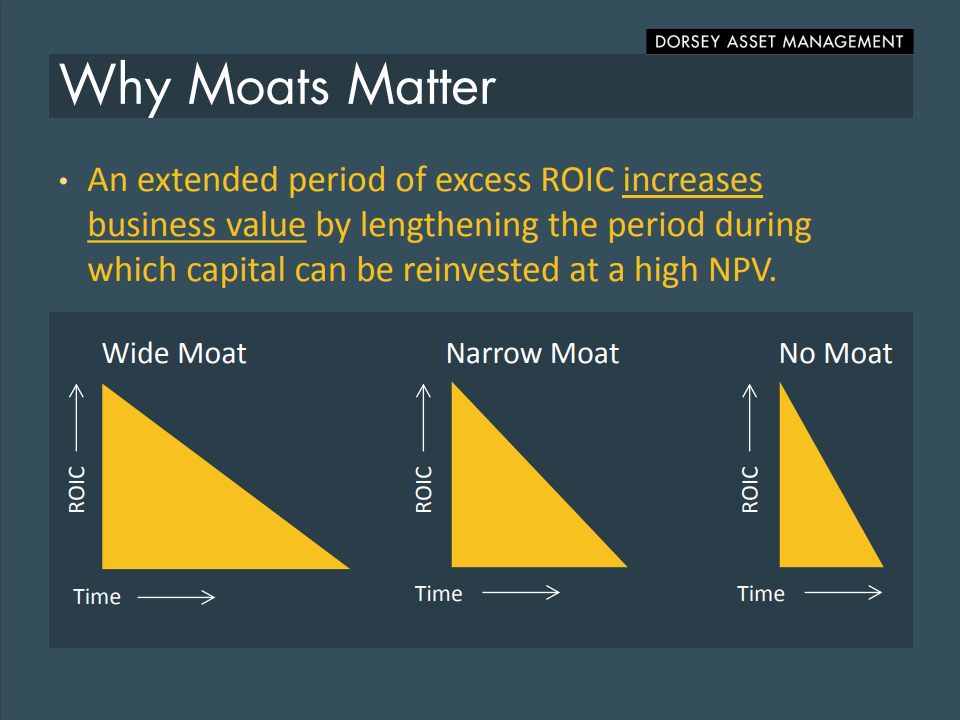

Dorsey Capital Management’s latest presentation on competitive advantages and capital allocation. The reason why high-quality wide-moat companies are usually more expensive than the broad market is the increased period at which capital can be reinvested at high rates of return. The terminal value is a big component of a discounted cash flow model. High-quality wide moat companies have a higher terminal value.

If you put Napoleon in any other situation would he have excelled there too? According to Eagle Point Capital, John Rockefeller thought Napoleon would have been a great businessman. So what lessons from Napoleon’s life can we apply to business and investing?

GMO is a big proponent of quality investing and they find the quality anomaly exists outside of stocks and in bonds too.

Nike will flow money to Hibbets (HIBB) because they are crucial to the urban street market. And I would've paid good money to watch John Hempton's site visits and in-person research.

The disruptive threat LLMs pose to Google’s monopolistic position in search.